3 risky pot stocks with breathtaking growth potential

[ad_1]

DDespite the meteoric growth of the legal marijuana industry over the past few years, cannabis stocks have generally been a drag for investors. Cannabis stocks have stagnated over the past three years for a long list of reasons.

Some of the common threads running through this disappointing period in the industry lifecycle include: overzealous management teams, a sea of ​​endless capital increases at shareholder expense, government red tape, banking / debt issues. funding, the slow march towards federal legalization in the United States, and of course, competition from legal and illegal producers. Following this vortex of hurricane-force headwinds, the industry‘s flagship ETF – Horizons Marijuana Life Sciences NBIF – lost more than 56% of its value during the previous 36 month period.

HMMJ data by YCharts

However, the overall growth potential of the industry is beyond doubt. The legal global cannabis market is expected to generate $ 70.6 billion in sales by 2028, according to a report from Grand View Research. Legal marijuana sales, in fact, are expected to increase at a compound annual growth rate of 26.7% over the next seven years. If this prediction holds true, marijuana would easily be one of the fastest growing industries in the world during this time frame.

How can marijuana investors capitalize on this parabolic growth trend? There are two emerging trends that investors should consider when buying marijuana stocks right now. In the high end from a market capitalization perspective, investors should arguably appreciate a company’s ability to simply stay in the game until the United States allows THC sales nationwide. . Second, customers are said to be shifting their tastes to better quality dried flowers produced by elite artisan growers. With this knowledge, Canopy growth (NYSEMKT: CGC), Organizational chart (NASDAQ: OGI), and Producers of sundials (NASDAQ: SNDL) are three names that could be big winners for patient investors. Here’s why.

Image source: Getty Images.

Canopy, OrganiGram and Sundial stand out from the crowd

Canopy Growth is Canada’s top seller of premium dried flowers, according to data from cannabis research firm Hifyre. Additionally, Canopy recently announced that its vape and edible products are also performing well in the market. Despite this, Canopy’s shares have fallen more than 44% so far this year. Investors pulled out of this pot stock this year in response to the company’s inability to make a profit, as well as its high rate of cash consumption. The move towards very high-quality artisanal products and the company’s decision to place a strong emphasis on the largely banned US market hurt its sales in 2021.

Canopy’s saving grace, however, is undoubtedly its partnership with the American alcohol titan. Constellation brands. This partnership should give the company the lead it needs to wait for most of its potential competitors and potentially capture a disproportionate part of the US market with federal authorization. The big picture is that Canopy is one of the few pot companies with a realistic chance of owning a double-digit share of the huge global cannabis space by the end of the decade. All he has to do is hang on as US federal law evolves slowly but surely.

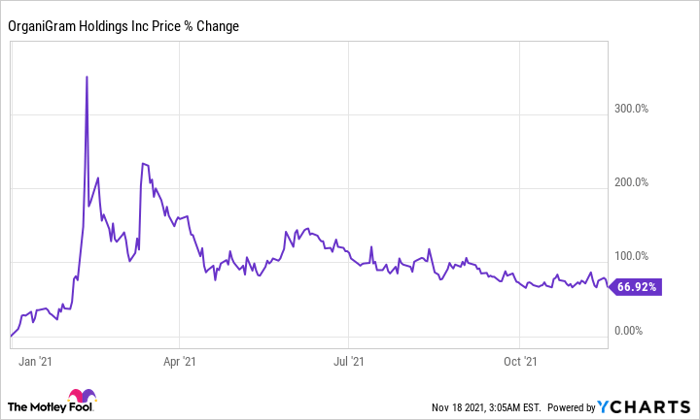

Handicraft producer OrganiGram has been one of the few bright spots among licensed Canadian producers this year. The New Brunswick-based cannabis company has seen its share price rise nearly 67% since the start of the year. Investors rewarded the company for cutting expenses through improved automation and higher returns, reducing debt to near zero and significantly increasing its market share in 2021. OrganiGram’s focus on efficiency and quality are clearly starting to pay off for the company. OrganiGram’s outstanding performance – in an otherwise dismal year for licensed Canadian producers in general – likely means that it will ultimately be bought out at a very high price by one of the industry’s starving titans. income.

OGI data by YCharts

Canada’s Sundial Growers is also an interesting buy and long term hold at the moment. The company has built a very diverse business that consists of a cannabis retail segment, a cannabis investment wing and now an alcohol component. Sundial shares, however, appear to be a great long-term buy for two completely different reasons.

First, it has an exceptionally healthy balance sheet, with C $ 1.2 billion in the bank and no outstanding debt at last count. Second, Sundial recently embarked on a C $ 100 million share repurchase program. This key operational move is expected to increase earnings per share over the next few quarters and end the company’s penchant for shareholder dilution. All of this means that Sundial should be able to remain a viable independent entity. So, like Canopy, Sundial’s share price should greatly benefit the company from its simple ability to stick around as the industry matures.

Here’s the marijuana stock you’ve been waiting for

A little-known Canadian company has just unlocked what some experts believe is the key to profiting from the coming marijuana boom.

And make no mistake, it does happen.

Cannabis legalization is sweeping across North America – 15 states plus Washington, DC, have all legalized recreational marijuana in recent years, and full legalization arrived in Canada in October 2018.

And an under-the-radar Canadian business is about to explode because of this upcoming marijuana revolution.

Because a game-changing deal has just been struck between the Government of Ontario and this mighty company … and you must hear this story today if you’ve even considered investing in pot stocks. .

Just click here to get the full story now.

Learn more

Georges budwell has no position in any of the stocks mentioned. The Motley Fool owns shares and recommends Constellation Brands and OrganiGram Holdings. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Comments are closed.